The Federal Government of Nigeria has announced its qualification for a loan from the World Bank, totaling $2.25 billion.

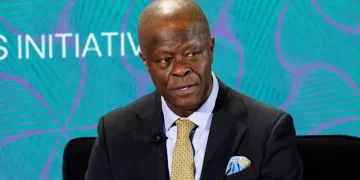

Wale Edun, the finance minister, unveiled this milestone during a joint press conference held by the Ministry of Finance and the Central Bank of Nigeria (CBN) at the spring meetings of the International Monetary Fund (IMF) and the World Bank in Washington D.C.

He said the package, approved by the Board of Directors of the World Bank, offers a 40-year term with a 10-year moratorium and a nominal 1 percent interest rate.

Edun said, “If you look at the fact that we have qualified for the processing, just this week to the Board of Directors of the World Bank, of the total package of $2.25 billion of what you can call, I mean, if there is no such thing as a free lunch, but it is the closest you can get to free money. It is virtually a grant. It is for about 40 years, 10 years moratorium and about 1% interest. So that also is part of the flow you can count.”

He added that Nigeria is set to benefit from budgetary support and low-interest funding from the African Development Bank, noting that negotiations with foreign direct investors are also underway.

Edun addressed concerns about debt sustainability by emphasizing the pivotal role of revenue generation in Nigeria’s economic strategy.

He highlighted oil revenue as a primary source and President Bola Tinubu’s ambitious goal to increase oil production from 1.6 million barrels per day to 2 million barrels per day.

“These measures are crucial for enhancing our fiscal resilience and ensuring long-term economic stability,” the finance minister said.

In a bid to strengthen its foreign exchange reserves and attract investment, Nigeria is exploring innovative avenues with particular emphasis on leveraging remittances from its diaspora community.

The finance minister underscored the immense potential of Nigerians living abroad, acknowledging their substantial financial resources that could significantly benefit the Nigerian economy.

“There are Nigerians abroad who are thriving financially,” remarked Edun, emphasizing their capacity to make substantial contributions to Nigeria’s economic growth and development.

“The government is looking at attracting those funds and capturing those funds through a diaspora type of instrument, a diaspora bond. We think that would be a very attractive instrument for Nigerians abroad and for foreign holdings of foreign currency and we look to having a substantive, substantial and successful issue later in the year,” Edun revealed.

Read original article on Vanguard