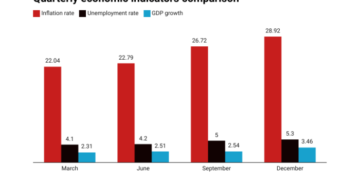

Nigeria finds itself entangled in a challenging combination of soaring inflation, economic downturn, and mounting joblessness; a scenario commonly referred to as ‘stagflation’ by economists. Stagflation is characterised by a simultaneous rise in inflation and unemployment rates alongside slowing economic growth.

Data from the National Bureau of Statistics (NBS) confirm this, with a recent publication showing a rise in the unemployment rate from 4.2 percent to 5.0 percent in the third quarter, a staggering 0.8 percent increase.

Similarly, the same source reveals that the inflation rate has increased from 28.92 percent in December 2023 to 29.9 percent in January 2024, reflecting a 0.98 percent increase, as reported earlier by BusinessDay.

Thus, the simultaneous increase in both macroeconomic indicators – unemployment and inflation rates – amidst sluggish GDP growth defines stagflation, underscoring a troubling economic scenario.

It would be misleading to claim there’s no connection between President Bola Tinubu’s policies and the increase in unemployment in Nigeria, considering the evident signs from various indicators, such as the rise in living expenses following the removal of subsidies.

Furthermore, the departure of major corporations, such as P & G, GlaxoSmithKline, Sanofi and partly Shell for strategic purposes, amidst soaring operational costs due to fuel price hikes and currency volatility, has exacerbated the economic challenges.

These corporations, which collectively employed over tens of thousands of individuals, have exited the country, and their staffs have now joined the ranks of the unemployed, further fueling the rise in unemployment rates.

The spillover effects of their departure are expected to intensify pressure on the job market, compounded by the relentless increase in inflation rates, particularly in food prices that have pushed food inflation rate to rise to 35.41 percent from 33.3 percent, a staggering 2.11 percent increase, according to data from NBS.

“I never imagined I’d be in this situation,” laments an anonymous victim of the multinational corporations’ retrenchment. “Losing my job has turned my life upside down. It’s not just about the income; it’s about the sense of security and stability that comes with it. I’m struggling to make ends meet, and the uncertainty of finding another job is overwhelming.” a senior executive at a consumer goods firm said on condition of anonymity.

This individual’s story reflects the harsh reality faced by many affected by these economic upheavals, highlighting the profound human toll of such policies.

Regrettably, the economy is now grappling not only with inflation and food inflation but also with rising unemployment rates—a phenomenon known as stagflation. The ripple effects of food price inflation have pushed over 104 million Nigerians into poverty, according to a recent World Bank report.

“Regrettably, the economy is now grappling not only with inflation and food inflation but also with rising unemployment rates—a phenomenon known as stagflation.”

With over 46 percent of Nigerians already vulnerable due to the rising cost of living, the uptick in the unemployment rate to 5.0 percent adds more fuel to an already volatile situation, ushering in a period of profound hardship.

President Bola Tinubu’s defence of these policies, citing their necessity to attract investment and bolster government finances, seems to overlook the immediate hardships faced by ordinary citizens.

This stance contradicts the views of John Maynard Keynes, renowned economist, who famously remarked, “There’s nothing like the long-run, because in the long-run, everybody will have died.”

In the face of such economic challenges, the government’s insistence on prioritising long-term goals over addressing immediate needs appears out of touch with the harsh realities on the ground.

As one observer, @waspapping on ‘X’, aptly put it, “The government is playing with fire if they think Nigerians can endure hunger. Tamper with fuel and electricity, etc., but make food affordable.”

These figures depict a complex economic situation in Nigeria, with increasing inflation and unemployment alongside modest GDP growth. The continuous rise in inflation indicates growing pressure on Nigerians’ consumer purchasing power, impacting the overall cost of living. At the same time, the rising unemployment rate suggests challenges in the labour market for Nigerians, affecting economic productivity and household income. While there is some optimism in the modest GDP growth, it may not fully offset the broader economic challenges faced by Nigerians posed by inflation and unemployment.

Digging deeper, NBS further reveals that the unemployment rate among youth aged (15-24 years) was 8.6 percent in Q3 from 7.2 percent in Q2 and that the unemployment rate in urban areas was 6.0 percent in Q3, a slight increase of 0.1 from Q2 2023.

Gbenga Alawode, an information technology economist, emphasised the significance of the recent uptick in youth unemployment, noting its potential to exacerbate existing challenges. With youth unemployment rising to 8.6 percent in Q3 from 7.2 percent in Q2, concerns loom over the ability to provide employment opportunities for young individuals, risking widened economic disparities and compromised long-term growth prospects.

Additionally, Alawode highlighted the delicate nature of the urban employment landscape, as evidenced by the marginal increase in urban unemployment to 6.0 percent in Q3 from 5.9 percent in Q2. While stability is reassuring, even minor shifts could signify underlying economic strains or sector-specific hurdles, warranting careful scrutiny and proactive measures to address emerging challenges.

Adejolu Joules, providing insights from the perspective of an investment analyst, emphasises the far-reaching effects of the surge in youth unemployment on market dynamics.

“As youth form a significant consumer group, their increased unemployment can notably reduce spending and demand for various products and services. This shift in consumer behaviour may influence investment choices, particularly in sectors targeting younger demographics.

“Conversely, the steadiness in urban unemployment rates implies a relatively stable economic situation in urban areas. However, even slight changes in these rates could have significant impacts on investment strategies, highlighting the importance of carefully assessing sectoral performance and growth prospects within urban economies.”

“Opeyemi, a co-worker at Omo-Oba Autos along Olambe-Giwa Road, expressed, ‘The impact of the recent surge in inflation, attributed to subsidy removal and currency unification, has been keenly felt.’ He emphasised, ‘These measures have significantly escalated our operational costs, particularly the expenses incurred in clearing vehicles at Apapa-Lagos.’

With prices soaring, consumer purchasing power has diminished, leading to a noticeable downturn in demand for their vehicles. The economic uncertainty compounds the challenges, making planning and forecasting exceptionally daunting.’ ‘To sell even a car is war,’ he added.”

In the midst of subsidy removal and currency instability as well as rising insecurity, businesses are grappling with mounting challenges. A Master Baker of Ase-Oluwa bread shared his concerns, stating, ‘It’s crazy to continue operations in this period.’

He highlighted how subsidy removal has driven fuel costs sky-high, significantly impacting bread production expenses. ‘We cannot keep raising prices,’ he lamented. ‘With queues forming at fuel stations once more, how can I expect my staff to continue production?’ In light of these hurdles, he made the difficult decision to close shop until further notice, leaving his employees without work.”

Amidst these challenges, there’s a resounding call for leadership to prioritise the immediate needs of the populace while navigating the path to long-term economic stability.

Several developing nations, including Brazil, have grappled with stagflation, marked by soaring inflation rates, escalating unemployment, and stagnant growth. Brazil’s experience in the 1980s, highlighted by data from the Brazilian Institute of Geography and Statistics (IBGE), underscores the severity of this crisis, with inflation peaking at over 2,000 percent annually.

To combat stagflation, Brazil implemented the Plano Real in 1994, introducing a new currency and enacting stringent fiscal and monetary policies. Market-oriented reforms, such as trade liberalisation and privatisation, were pursued to enhance competitiveness.

Additionally, social policies aimed at reducing poverty and inequality helped mitigate stagflation’s impact on vulnerable communities. While Brazil’s approach proved successful, challenges persist, emphasising the importance of continued policy action and socioeconomic initiatives.

Similarly, other nations like Argentina, Turkey, India, and Venezuela have faced similar struggles with stagflation, each adopting unique measures to address it. Despite Venezuela’s rich underground resources, including crude oil, mismanagement, political instability, and economic sanctions have led to severe stagflation.

Despite efforts to control hyperinflation, Venezuela continues to face social unrest and humanitarian crises, highlighting the complex interplay between natural resource wealth, political stability, and economic management.

As Nigeria faces stagflation, with unemployment at 5.0 percent and inflation at 29.9 percent, alongside a GDP growth dip to 2.74 percent in 2023 from 3.10 percent in 2022, it’s crucial to balance addressing current issues while aiming for lasting prosperity.

Learning from Brazil’s success in managing stagflation to avoid Venezuela’s situation is key. This requires teamwork among policymakers and stakeholders to ensure short-term actions support long-term economic growth, as advised by The Professional Updated forum.

To address these pressing issues, Nigeria’s government should consider adopting successful strategies employed by other countries:

Implement targeted monetary policies:

The Central Bank of Nigeria can play a pivotal role in curbing inflation and stimulating economic growth. By adjusting interest rates and employing open market operations, the central bank can effectively manage the money supply, thereby controlling inflationary pressures while fostering investment and consumer spending.

Foster sustainable fiscal policies:

Prioritising fiscal discipline is essential. The government should focus on enhancing revenue generation and reducing unnecessary spending. This includes implementing tax reforms to broaden the tax base, curbing wasteful expenditure, and promoting transparency and accountability in public finances. Adopting prudent fiscal policies will create a conducive environment for sustainable economic growth.

Enhance social safety nets:

Strengthening social safety nets is critical to support individuals and families affected by rising unemployment and inflation. This entails expanding social assistance programs, providing targeted subsidies for essential goods and services, and investing in skills training and job retraining initiatives. These measures will help displaced workers transition to new employment opportunities, fostering resilience in the face of economic challenges.

Oluwatobi Ojabello, senior economic analyst at BusinessDay, holds a BSc and an MSc in Economics as well as a PhD (in view) in Economics (Covenant, Ota).

Curled from BusinessDay